- Introduction

Artificial intelligence (AI) transforms numerous industries, and its application in the financial sector, particularly in stock market risk management, becomes increasingly prominent. Stock markets are inherently volatile, influenced by a complex array of factors, including economic conditions, investor sentiment, geopolitical events, and technological disruptions. Traditionally, managing risks in such an environment required the expertise of financial analysts and the use of statistical models. The rise of AI introduces new methodologies that allow for the rapid analysis of vast amounts of data and offers predictive insights and automated decision-making tools that surpass human capabilities.

Systems powered on AI in stock markets are now capable of analyzing both structured and unstructured data, including financial statements, market reports, social media trends, and even global news events, to predict market movements and assess risks with a high degree of accuracy. Machine learning models, neural networks, and deep learning techniques are leveraged to continuously adapt and improve these predictions based on historical and real-time data. Algorithmic trading, driven by AI, has also gained traction as it automates trading strategies to minimize risks and maximize profits. The goal of this paper – to explore the role of AI in enhancing risk management strategies on stock markets.

- Main part. Analysis of methods and technologies of AI in risk management

The application of AI in stock market risk assessment involves various advanced methods and technologies that empower analysts and investors to predict, monitor, and mitigate risks. These methods go beyond traditional statistical approaches, leveraging vast amounts of structured and unstructured data to generate insights in real time [1]. The integration of diverse technologies is important for enhancing the efficiency of economic institutions and operations, as it enables more accurate decision-making and optimizes performance in a rapidly changing financial landscape [2].

Machine learning (ML) is at the core of AI applications in stock market risk management. ML algorithms allow systems to automatically learn from historical data, improving their predictions without explicit human intervention. In risk management, ML models analyze massive datasets from various sources, such as price history, financial statements, and market sentiment, to identify patterns and anomalies. Two prominent types of ML used in stock markets are supervised learning and unsupervised learning.

- Supervised learning algorithms are trained on labeled datasets, where input data (e.g., past stock prices) is linked to known outcomes (e.g., stock movements). These models are used for predictive tasks such as forecasting price trends, assessing market volatility, and calculating risk exposure.

- Unsupervised learning identifies hidden patterns in unlabeled data, making it useful for anomaly detection and clustering. It helps detect unusual market behaviors, such as irregular trading volumes or sudden shifts in market sentiment, that may signal risk[3].

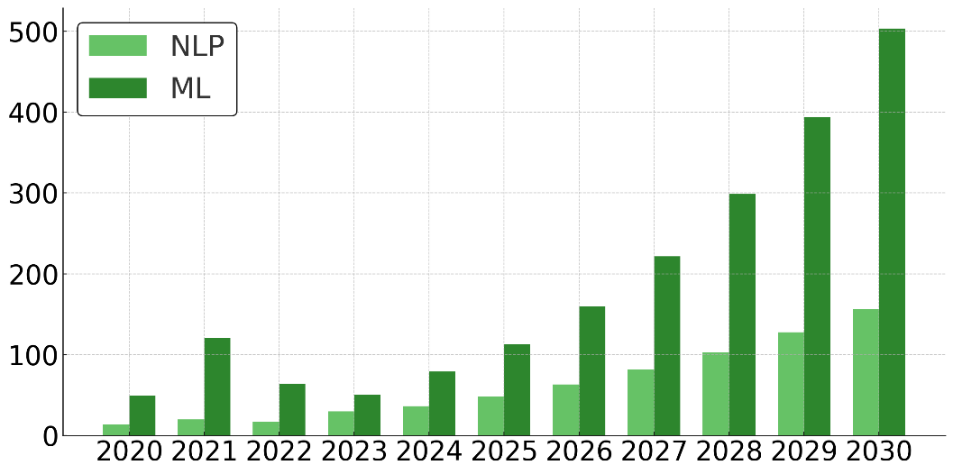

These models continuously evolve and learn from both historical data and real-time market movements to provide increasingly accurate risk assessments. The growth in the share of ML, along with natural language processing (NLP), which is also a popular tool, indicates a steady and significant increase in the use and investment in these technologies (fig. 1).

Figure 1. Worldwide market size of ML and deep learning technologies, billion dollars [4]

An AI technology that enables machines to interpret and process human language is NLP. In stock market risk management, NLP is primarily used to extract insights from unstructured data sources such as news articles, financial reports, social media, and regulatory filings. These algorithms can automatically scan news headlines and assess their potential impact on stock prices. By analyzing the tone, frequency, and relevance of the news, NLP models can gauge market sentiment and identify possible risks. Such models can track social media trends to detect shifts in investor sentiment, such as increased negative discussions about a particular stock, which may suggest an upcoming sell-off.

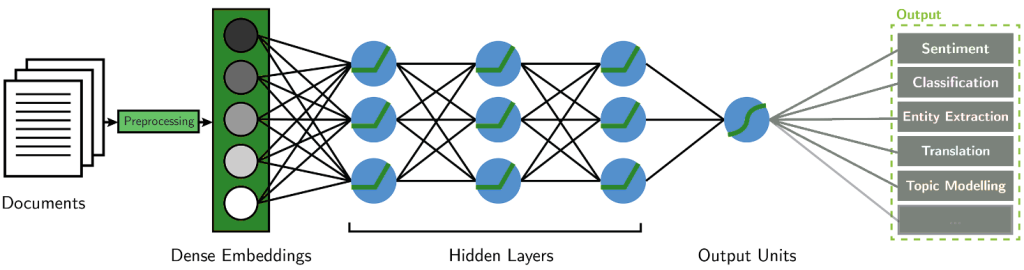

Deep learning (DL), a subset of ML, utilizes neural networks to analyze and process vast amounts of data with multiple layers of abstraction. It is especially useful for tasks that involve large, complex datasets such as high-frequency trading, financial news analysis, or social media sentiment tracking (fig. 2).

Figure 2. DL scheme

In stock markets, DL models can recognize intricate patterns and correlations across numerous data points, helping investors identify hidden risks and opportunities. A DL model can analyze millions of data points related to economic indicators, geopolitical events, and market fluctuations to predict downturns or surges in asset prices.

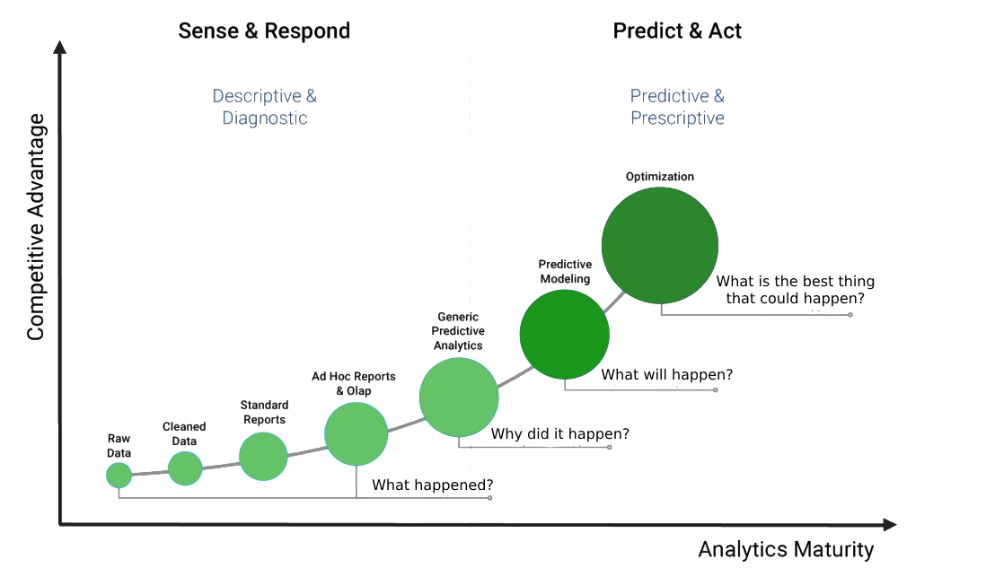

Predictive analytics encompasses a wide range of AI techniques aimed at forecasting future outcomes based on historical and real-time data. It is a critical component of risk management on stock markets, where anticipation of market movements, price fluctuations, and volatility is key to mitigating risks (fig. 3).

Figure 3. Predictive analytics scheme

Predictive models are built using ML, deep learning, and statistical methods, offering insights into future stock price trends, potential market crashes, and economic downturns. These models take into account various factors, including historical price data, macroeconomic indicators, and market sentiment, to generate probabilistic risk forecasts.

Algorithmic trading, also known as «algo-trading», uses AI-powered algorithms to execute trades at high speeds based on predefined criteria. These algorithms are designed to analyze real-time market data, identify favorable trading opportunities, and make decisions in milliseconds. AI-based algorithms are capable of making complex, high-frequency trades while simultaneously minimizing risks and maximizing returns. AI-powered algorithmic trading systems excel in risk management by dynamically adjusting their trading strategies in response to real-time market changes.

Big data analytics refers to the use of AI techniques to process and analyze massive volumes of data that exceed the capacity of traditional systems. In stock market risk management, big data plays a pivotal role in uncovering patterns and trends that may not be visible through traditional data analysis. AI technologies, particularly in combination with big data, enable the processing of diverse data types, including market transactions, news events, financial reports, and even sentiment analysis from social media. By integrating these sources, AI systems can offer a more comprehensive risk assessment, helping investors identify both long-term risks and short-term opportunities.

The combination of AI methods and technologies, including ML, deep learning, NLP, predictive analytics, algorithmic trading, and big data analytics, has revolutionized risk management in stock markets. These tools allow for more accurate predictions, faster response times, and better decision-making in the face of market volatility. As AI continues to evolve, its role in managing financial risks is likely to expand, offering even more sophisticated and reliable solutions for investors and financial institutions.

- Analysis of ML models performance for risk management in stock markets

Models based on ML have become essential tools for risk management in stock markets due to their ability to analyze large datasets, recognize patterns, and make accurate predictions. These models enable investors and analysts to assess market risks more effectively by using historical data, real-time information, and sophisticated algorithms to identify trends and potential threats.

Linear Regression (LR) is one of the simplest statistical models used in stock market prediction. It attempts to model the relationship between a dependent variable (e.g., stock prices) and one or more independent variables (e.g., time, economic factors) by fitting a linear equation to observed data.

Random Forest (RF) is an ensemble learning method that builds multiple decision trees and merges them together to create a more accurate and stable prediction. It reduces overfitting and increases accuracy. It is used to analyze large datasets with multiple variables, such as stock prices, trading volume, and economic indicators. It is highly effective for feature selection, portfolio optimization, and risk assessment by predicting stock performance based on historical and current data [5].

Neural networks (NN), especially deep learning models, are highly flexible and capable of capturing complex patterns in financial data. They consist of layers of artificial neurons that mimic the structure of the human brain, making them well-suited for tasks such as stock price prediction, sentiment analysis, and volatility forecasting. In risk management, NN are often used to model non-linear relationships between various market indicators, such as stock prices, trading volumes, and economic variables. A 2023 study conducted a comparative assessment of the accuracy of LR and NN for American corporate stocks in February 2023 [6]. It was shown that NN had higher accuracy in predicting prices compared to LR, demonstrating its high effectiveness in evaluating stock market metrics (table 1).

Table 1

The predicted stock prices for Microsoft, Amazon, and Google on February 29, 2023, by the LR and NN, and the average percent errors

| Company | Linear Regression | Neural Network | Actual price | Linear Regression error | Neural Network error |

| Microsoft | $250,10 | $250,76 | $250,76 | 0,54% | 0,29% |

| Amazon | $93,76 | $93,80 | $93,87 | 0,62% | 0,47% |

| $89,75 | $89,85 | $90,16 | 1,83% | 1,38% |

There are several types of NN models. Recurrent Neural Networks (RNN) are a class of neural networks specifically designed for processing sequences of data. They are particularly effective when dealing with time-series data, as they have the ability to remember previous inputs and use them in their decision-making process. They are used for predicting stock prices because of their ability to learn from historical stock price data over time. Convolutional Neural Networks (CNN) are mostly known for their use in image processing, but they can also be applied to time-series data like stock prices. By focusing on patterns and structures within data, CNN can efficiently extract key features.

Gradient Boosting Machine (GBM) is an ensemble learning technique that builds models sequentially, with each model trying to correct the errors of its predecessor. It focuses on minimizing errors, making it a powerful method for predictions. Gaussian Naive Bayes (GNB) is a classification model based on Bayes’ Theorem, assuming that the features follow a Gaussian (normal) distribution. It is efficient but may not always perform well with highly correlated features or non-Gaussian data. Bernoulli Naive Bayes (BNB) is another Naive Bayes variant that works with binary/Boolean features. It is useful for datasets where the features are binary but may not capture relationships as effectively as other models.

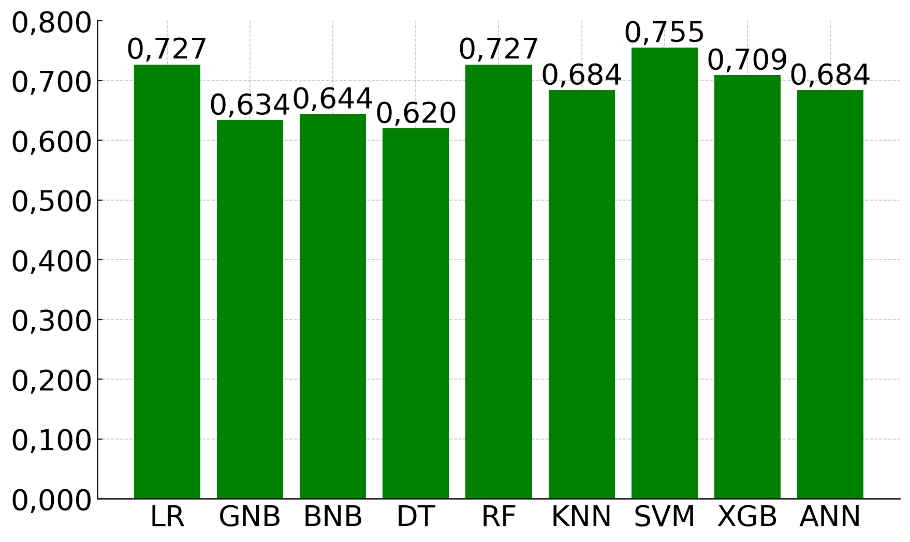

Support Vector Machines (SVM) are supervised learning models used for classification and regression tasks. In the context of stock market predictions, SVM are primarily employed to classify stocks based on their risk levels, movements (upward or downward), or other financial characteristics. SVM are widely used for their ability to handle both linear and non-linear data, making them useful in classifying market trends. According to 2024 research [7], SVM is the most cited and studied model for assessing stock market risk, appearing in 25 % of all related studies. The effectiveness of SVM is demonstrated by a study conducted in 2021 [8], which examined the performance of various ML models. The highest accuracy was observed in SVM, followed by LR and RF (fig. 4).

Figure 4. Accuracy performance of various ML models

Models based on ML offer a wide range of tools for stock market risk management, from simple linear regression to complex neural networks and reinforcement learning systems. Investors and financial institutions can make more informed decisions, anticipate financial risk, and develop strategies to mitigate potential losses with the implementation of these models.

- Conclusion

The incorporation of AI into stock market risk management significantly changes how investors and financial institutions address uncertainty and handle market volatility. By leveraging advanced ML models, such as linear regression, support vector machines, random forests, and deep learning architectures, AI systems can process vast amounts of data, identify hidden patterns, and generate accurate predictions that help mitigate risks. These AI-driven models provide investors with powerful tools to make informed decisions, automate trading strategies, and optimize portfolios in real-time.

References

1. Bobunov A. Adaptation and implementation of international software quality standards in financial institutions // The scientific online journal “Stolypinsky Bulletin”. – 2024. – № 9/2024.2. Verner D. Economic aspects of implementing cloud solutions in business operations // Znanstvena Misel. – 2024. – № 94. – C. 30-33.

3. Jain R., Rakesh V. Emerging Trends in AI-Based Stock Market Prediction: A Comprehensive and Systematic Review // Engineering Proceedings. – 2023. – Vol. 56. – № 1. – P. 254.

4. Artificial Intelligence – Worldwide / Statista // URL: https://www.statista.com/outlook/tmo/artificial-intelligence/worldwide (date of application: 17.09.2024).

5. Sonkavde G., Dharrao D.S., Bongale A.M., Deokate S.T., Doreswamy D., Bhat S.K. Forecasting stock market prices using machine learning and deep learning models: A systematic review, performance analysis and discussion of implications // International Journal of Financial Studies. – 2023. – Vol. 11. – № 3. – P. 94.

6. Cilingiroglu E. Artificial Intelligence in the Stock Market: Quantitative Technical Analysis, Model Weight Optimization, and Financial Sentiment Evaluation to Predict Stock Prices // Intersect: The Stanford Journal of Science, Technology, and Society. – 2023. – Vol. 17. – № 1.

7. Lin C.Y., Marques J.A. Stock market prediction using Artificial Intelligence: A systematic review of Systematic Reviews // Social Sciences & Humanities Open. – 2024. – Vol. 9. – P. 100864.

8. Mokhtari S., Yen K., Liu J. Effectiveness of Artificial Intelligence in Stock Market Prediction based on Machine Learning // International Journal of Computer Applications. – 2021. – Vol. 183. – P. 1-8.