One of the main services of commercial banks is lending to legal entities and individuals. Increased competition in the banking sector, economic instability, the impact of economic sanctions and pandemics lead to increased opportunities for lending to small businesses, although this segment of services is characterized by increased risk [1,2].

However, when focusing on credit services for small businesses, commercial banks must take into account the specifics of small businesses. This is especially true for small and medium-sized banks, which can conduct their credit policy more flexibly [3,4,5].

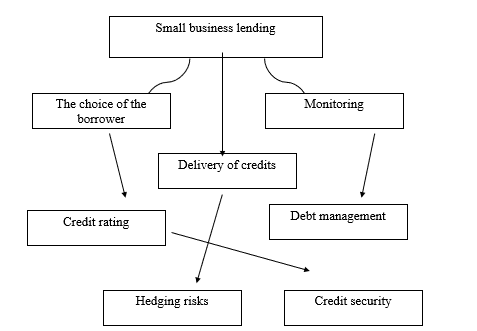

In general, the traditional process of lending to small businesses can be represented as three stages: the assessment of the borrower, the provision of credit and subsequent control. But in our opinion, the process of bank lending to small businesses can be supplemented and presented in the form of the following scheme (fig. 1).

An important stage in the process of lending to small businesses is the choice of the borrower by the bank [6,7]. At the same time, banks are recommended to distinguish the typology of clients, which is shown in table 1.

This typology makes it easier to work at the initial stage of the lending process. The client contacts the bank, and the credit specialist asks him a simple question: «Are you a bank client?». Based on the response, the program issues either a questionnaire or a client’s dossier. Since the bank’s clients already have both a dossier and a credit history, it is no longer necessary to spend time on this. And if this is a potential or sleeping client, then you need to understand whether it is significant for this bank or not.

Figure 1. The process of small business lending

Table 1

Typology of commercial bank clients

| The characteristics of the client | Type of client | |||

| Potential | Developing | Developed | Sleeping | |

| Characteristics of relations with the bank | The client have not used the bank’s products before | The number of services used is growing. Positive emerging credit history | The number of services used is more than two and continues to increase. Positive established credit history. | The use of banking products is kept to a minimum.

The client has a positive credit history. |

| Number of used products | 0 | 1-2 | 3-4 | 0 |

| Number of active contracts | 0 | 1-2 | 3-4 | 0 |

According to the proposed approach to the lending process, determination of significance will be exposed to two of the five categories of customers: potential, as this group of customers were not customers of the bank, has no record, a new customer, so the bank for decision-making requires full information about the client; the second group that needs to be tested for «significance» is dormant customers.

This approach allows you to characterize the external environment of an enterprise, show its place in the market and in the industry, confirm or deny the legality and effectiveness of its activities, and determine the level of diversification. Having this kind of information, a commercial bank can determine the feasibility of providing a loan. The minimum number of points that can be scored is 9 points, and the maximum score is 20.

Based on this, you can determine the level of potential risk:

-0-12 points (0-60 %) — high level of risk. The client is not of any interest to the Bank. Such a client must be refused credit;

-13 — 16 points (65 — 80 %) — the average level of risk. You can skip this client for further verification;

-17-20 points (85-100 %) — minimal risk. For such a client, you can consider the details of the lending process.

The next stage of selecting a borrower is the assessment of its creditworthiness. The essence of this assessment in Russian banks is to check the indicators of financial and economic activity of the enterprise. This is an integral and important part that does not make sense to give up. In accordance with the developed system, indicators of financial and economic activity are evaluated using a point system.

The research can be carried out in the following areas:

- Select a group of indicators whose values are expressed in specific numbers or intervals of numbers:

-indicators of financial stability;

— indicators of solvency.

- Select a group of indicators whose values are expressed by positive or negative trends:

-absolute figure;

-profitability index;

-business activity indicators.

After assessing the creditworthiness of the borrower, you should proceed to the assessment of the loan collateral. Usually, this stage of the lending process is implemented at the stage of issuing a loan. But you can disagree with this. After all, the absence of property that can act as collateral for a loan can serve as a reason for refusing to provide credit funds.

In accordance with the foreign system of detailed assessment of a potential borrower, it is necessary to conduct a preliminary assessment of assets that can serve as collateral for the loan. According to the practice of Russian banks, collateral assessment is carried out immediately after the assessment of the company’s creditworthiness.

Based on the results of the collected information about the financial condition of the borrower and his moral and ethical qualities, as well as the analysis of secured property, the borrower is assigned one of three groups of creditworthiness: high, medium or low. All parameters that are taken into account are assumed to be equal to 100 %. The group is assigned depending on the percentage of deviations (table 2).

Table 2

Parameters of creditworthiness groups

| Creditworthiness groups | Maximum deviation,% | Group parameter,% |

| High | 25 | 100 — 75 |

| Average | 50 | 74 — 50 |

| Low | 100 | 49 or less |

If the analysis of the loan application and the financial condition of the borrower is positive, the issue of granting a loan may be submitted to a meeting of the Bank’s Credit Committee. In this case, the Credit Committee must submit a set of documents, which usually include: an application, a loan memorandum, and a certificate of possible conditions for granting a loan. If the Credit Committee has resolved the issue positively, the bank notifies the potential borrower of the decision and the terms of the loan. Then there is the process of preparing credit documentation, signing a loan agreement and issuing a loan. The loan is issued by the administrator, who can act as the credit division. The administrator opens a loan account for the borrower, deposits money to it, and writes off credit funds according to the purpose of the loan.

Next, the monitoring stage comes into force, during which the current monitoring of the borrower’s condition is performed using the periodic application of the «red signals» system, the borrower’s significance is periodically determined, and the use of reserve funds is monitored when detecting overdue loan debt. For the loan issued, its use (in the case of a target loan) and repayment (periodic interest payments in accordance with the schedule, if such are provided, and repayment of the principal amount of the loan), the availability and condition of collateral, for maintaining compliance with the terms of the loan fixed in the loan and other agreements, market conditions, etc., for changing the financial condition of the borrower in order to timely respond to negative changes in its position, which may affect the ability of the borrower to repay the loan, we need adequate control in the form of monitoring throughout the entire loan term. The ultimate goal of this control is to ensure that the loan is returned to the bank within the established period and in full, together with accrued interest.

The credit division and other services of the bank (accounting, legal and economic security services, collateral services, if any) participate in the process of such control.

The most important part of the monitoring process is constant monitoring of the financial situation of the borrower-a legal entity (small business). Such control may consist of periodic analysis of the company’s financial statements, as well as regular meetings with clients. In organizational terms, the procedure may look like this. The credit division submits a document with its conclusions and proposals to the authorized body of the bank for consideration if there have been significant negative changes in the financial position of the borrower. Based on this document, and depending on the severity of the changes, a decision is made on the actions to be taken in order to maintain the probability of loan repayment at an acceptable level.

A bank that cares about its reputation and strives to maintain good relations with the client will try to do everything possible to help the borrower out of this situation. This can be an increase in collateral for the loan, obtaining additional guarantees, or a requirement to repay the loan in part, and so on.

When organizing the process of lending to small businesses, banks take into account their characteristic features as subjects of credit relations.

First of all, this applies to the content side of all stages of the credit process, the methodology for analyzing the creditworthiness of borrowers. A certain difference can be seen in the nature of credit products, as well as in the terms of their provision.

If there are still so-called «problem loans», then at this stage of lending, there are three main ways to work with such loans. The first method is to collect credit debts on the bank’s own. This can be done by a credit division, the economic security service, or a specially created bank’s own service for dealing with such loans.

The second method is the transfer of credit debts for collection to a specialized collection agency, or there is also a method that involves the sale of debts

There is also the possibility of combining these methods in different «proportions». For example, at first the bank works with problem loans independently, and then transfers the remaining part to the collection agency.

Thus, the lending process used in a particular bank testifies to the commercial bank’s client orientation in the market, its ability to accept and distribute credit risks, and, ultimately, forms the availability (or unavailability) of its credit products for various economic entities.

References

1. Vissarionova T.A., Zernova L.E., Mishina E.Yu. Problems of financing small and medium-sized businesses in Russia // Modern Science. - 2019. - № 12-1. - pp. 21-25.2. Rakhmanova S.K., Zernova L.E. Features of lending to small businesses in commercial banks // Materials of the all-Russian scientific conference of young researchers "Vector-2018" - M.-2018-pp. 71-74.

3. Basareva V.G. Small business in the system of restoring the trajectory of economic growth // Problems of forecasting. - 2017. - N 5. - p.p. 79-87.

4. Bogoutdinov B. Small business of Russia: analysis of profitability and support measures // Society and economy. - 2016. - N 6. - p.p. 97-108.

5. Demkovich V.I. Small and medium business: modern challenges // Money and credit. - 2015. - N 11. - pp. 26-31.

6, Avrakhova Yu.V. Active operations of Russian banks [Electronic resource] - Access Mode

URL: https://elibrary.ru/download/elibrary_28410524_54208657.pdf (accessed 20.04.2020)

7. Bayram U.R., Safonova N.S. Bank investment lending: theoretical aspects and current state [Electronic resource] - Access Mode

URL: https://elibrary.ru/item.asp?id=27325921 (accessed 22.04.2020)