Relevance. The economic security of the Russian Federation plays a key role in ensuring sovereignty, social stability and sustainable economic growth. In the context of global changes related to the introduction of large-scale sanctions, increased geopolitical pressure and volatility of world markets, issues of protecting the national economy are becoming strategically important. From 2020 to 2024, Russia faced new challenges, including changes in the structure of external debt, sharp fluctuations in inflation, and the need to mobilize domestic reserves such as the National Welfare Fund. The relevance of the topic is also determined by the need to analyze the effectiveness of macroeconomic policy. The dynamics of key indicators allows us to assess the economy’s ability to adapt to new challenges and maintain stability.

Many scientists, associate professors and doctors of Economics have conducted their research on this topic. For example, Kiryanova Alina Leonidovna analyzes GDP in her work. If in 2000 the GDP of the Russian Federation was 3.3 trillion rubles, then by the end of 2021 it already amounted to 130.8 trillion rubles. Thus, in 2021, the total value of goods and services produced in the country increased by 18 times. This indicates not only the growth of the economy, but also the change in prices in general. It is believed that if the index exceeds the 100% mark, then there is an increase in the production of goods and services within the country compared to the previous period. And if the index is less than 100%, then there is a decrease in economic activity within the country. Let’s say the inflation rate in 2020 was 4.91, and in 2021 it was 8.39

During the study period, inflation increased by more than 2.5 times. According to Rosstat, the annual inflation rates in Russia over the specified period were as follows:: 2020 – 4.91%; 2021 – 8.39%; 2022 – 11.94%; 2023 – 7.42%; 2024 – 8.53% ( as of October). These data indicate significant fluctuations in the inflation rate during the period under review, with a peak in 2022 and a subsequent decline in 2023.

According to the report of the Central Bank of the Russian Federation, the indicator reached 8.39% in 2021..Thus, in her work, Kiryanova Alina Leonidovna concludes that most of the indicators showed positive dynamics over the period under study.In the journal “Current Research», the scientific supervisor Anatoly Konstantinovich Modenov analyzes such an indicator as external debt. By July 1, 2024, the external debt had decreased to $302 billion, which is 15% of GDP over the past 12 months. As of October 1, 2024, Russia’s external debt totaled $293.4 billion, falling below $300 billion for the first time since 2006.

The obligations of the private sector, including banks and other organizations, account for a significant share in the structure of external debt. As of July 1, 2024, the debt of other sectors of the economy amounted to $160.9 billion, which is 6.5% less than in the previous quarter. The debt of the banking sector increased by 7.4%, and the obligations of government agencies to non-residents increased by 1.5%. According to the Central Bank of Russia, the ratio of external debt to the country’s GDP showed the following dynamics: 2020 – 31%; 2021 – 26%; 2022 – 17%; 1 quarter of 2023 – 15%. These indicators indicate a significant reduction in the debt burden on the Russian economy over the period under review. The decrease in the ratio of external debt to GDP is due to several key factors: a reduction in the absolute volume of external debt, GDP growth and sanctions restrictions.

A comprehensive analysis showed that the economic security of the Russian Federation in 2019-2024 was subject to significant challenges, including the pressure of external sanctions, inflationary risks and global market volatility. Despite this, the reduction of external debt, the optimization of its ratio to GDP, measures to curb inflation and the effective management of the funds of the National Welfare Fund contributed to strengthening the macroeconomic stability of the country.

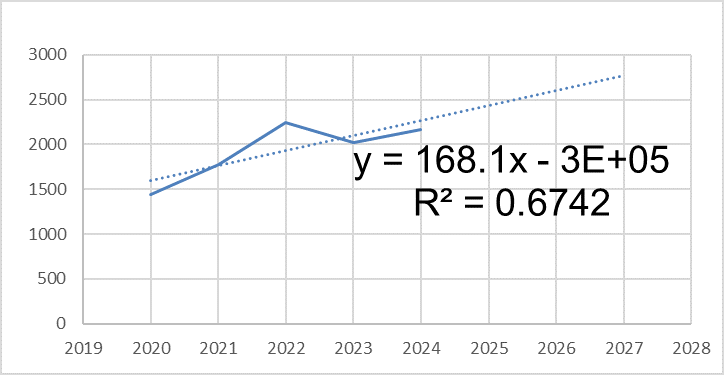

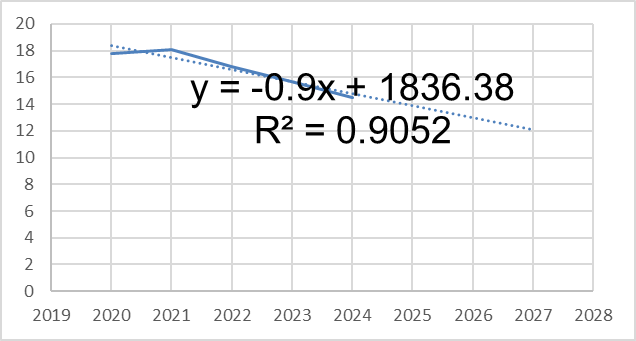

Pic.1 GDP, $ billion

There was significant GDP growth in 2021 and 2022, which may indicate economic recovery or productivity growth.

In 2023, there was a decline in GDP compared to 2022, which may indicate economic problems such as recession, declining demand, or other negative factors.

In 2024, there is a slight increase compared to 2023, which may be a sign of economic stabilization.

The dynamics of GDP shows that the economy has experienced significant fluctuations, with sharp growth in the first two years, followed by a decline and subsequent recovery.

The forecast for 2025-2026 is that GDP can continue to grow if the economy recovers and develops. However, it is important to keep in mind that forecasts can be subject to significant changes depending on economic, political and social factors.

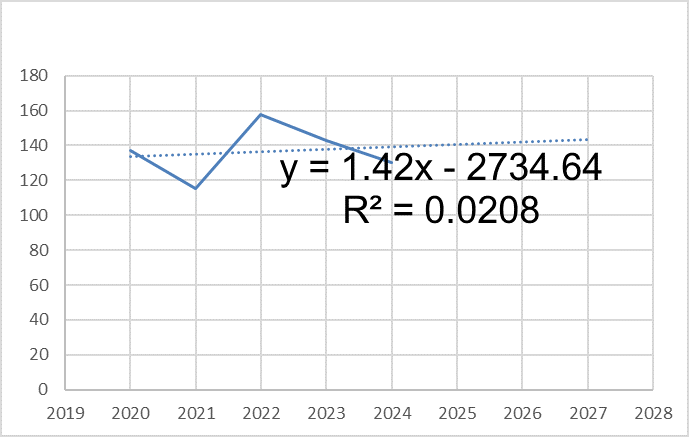

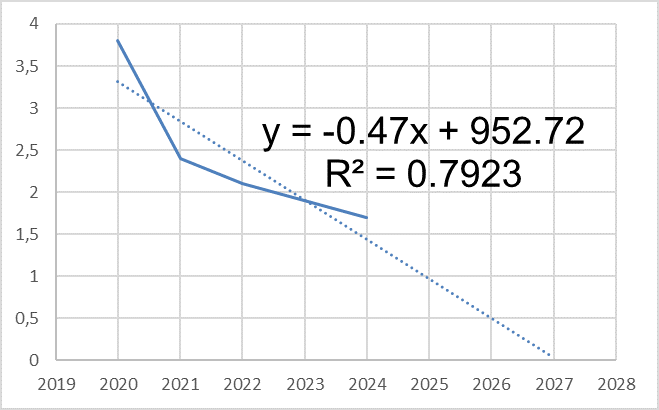

Pic. 2. Gross grain harvest, million tons

From 2020-2021, there has been a decrease, which may be due to unfavorable climatic conditions and a decrease in soil quality. Rising prices for seeds, fertilizers and fuel; in 2021-2022, the increase may be due to increased investment in agriculture and government support; in 2022-2024, a decrease.

If we make a forecast for 2025-2026, the gross grain harvest may remain at a level close to the current one, with a slight increase. However, it is important to take into account that factors such as climatic conditions, agronomic techniques and the economic situation can significantly affect the actual results.

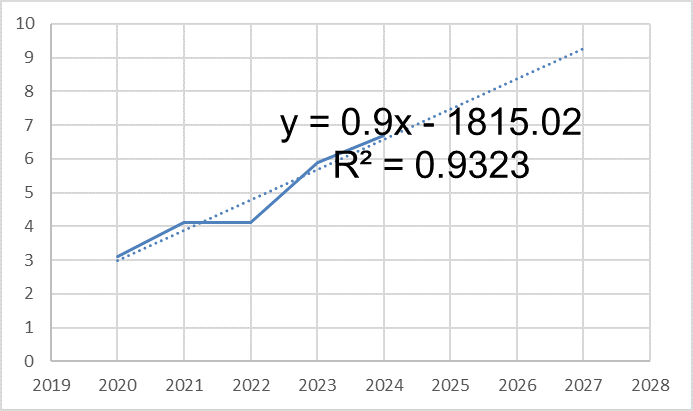

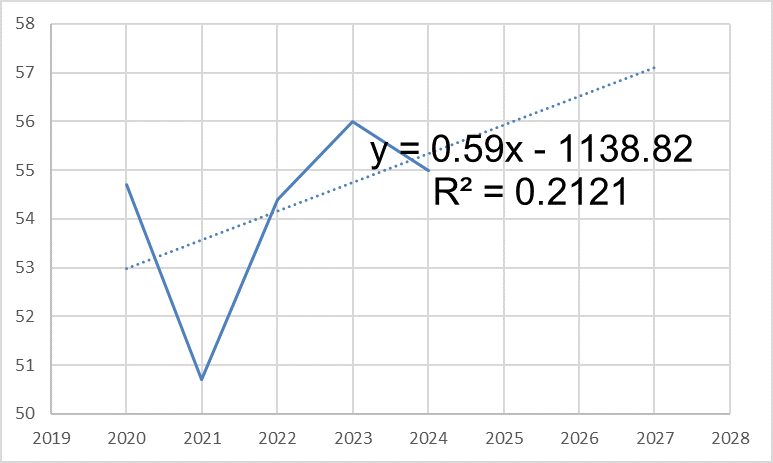

Pic. 3. Defense expenditure, % of GDP

There has been a steady increase in defense spending as a percentage of GDP since 2020.

The largest increase occurred in 2022-2023, which may be due to changes in the geopolitical situation or internal factors requiring increased military spending.

Growth continued in 2024, but the pace slowed compared to the previous year.

Defense spending as a percentage of GDP is showing steady growth, which may be related to changes in the international environment and domestic needs. The forecast for 2025 and 2026 suggests a further increase in spending, but the actual values may vary depending on a variety of factors, including the economic situation and political decisions.

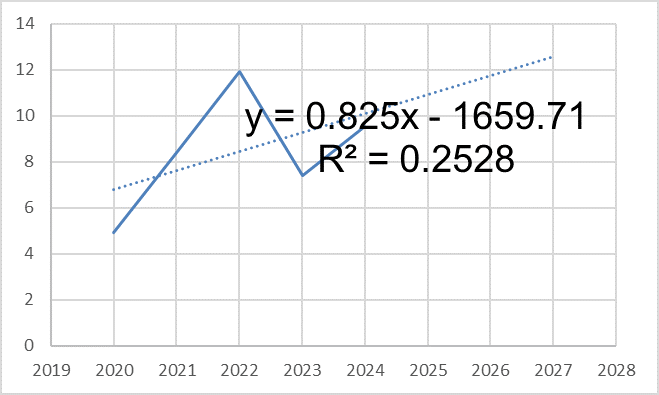

Pic. 4.Investments in fixed assets, % of GDP.

Investment growth: There is a general trend towards an increase in fixed asset investment as a percentage of GDP from 2020, which may indicate an increase in economic activity and investor confidence.

Decrease in 2021-2022: There was a slight decrease in 2022 compared to 2021, which may be due to economic or political factors affecting investment activity.

3.Recovery and growth: Since 2022, there has been a recovery and further growth in investment, which may indicate an improvement in the economic situation and an increase in demand for investment.

Investments in fixed assets as a percentage of GDP show overall growth, which may indicate positive changes in the economy. The forecast for 2025 and 2026 suggests a further increase in investments.

Pic. 5. Share of innovative products in total industrial output, %

Growth in 2020-2021: There is a positive trend in the share of innovative products, which may indicate an increase in investment in innovation and new technologies.

Sharp decline in 2021-2022: A significant drop in the share of innovative products in 2022 may be due to economic difficulties, changes in demand, or other factors affecting innovation activity.

Further decline in 2023: Continued decline in 2023 indicates continued challenges in the innovation sector.

Recovery in 2024: An increase in the share of innovative products in 2024 may indicate the beginning of recovery and an improvement in the innovation situation.

The share of innovative products in the total volume of industrial output shows significant fluctuations, which may indicate instability in the field of innovation. The forecast for 2025 and 2026 assumes a recovery and an increase in the share of innovative products.

Pic. 6. External debt, % of GDP

Growth in 2020-2021: A slight increase in external debt in 2021 may indicate an increase in borrowing, possibly to finance economic programs or support in times of instability.

Decrease from 2021: Starting from 2022, there has been a steady decrease in the share of external debt to GDP, which may indicate an improvement in the economic situation, an increase in GDP, or a reduction in external borrowing.

Reduction in 2023 and 2024: Continued reduction in the share of external debt in 2023 and 2024 may indicate successful debt management measures and improved financial stability.

The share of external debt as a percentage of GDP shows a downward trend, which may indicate an increase in financial stability and an improvement in the economic situation. The forecast for 2025 and 2026 suggests a further reduction in the share of external debt

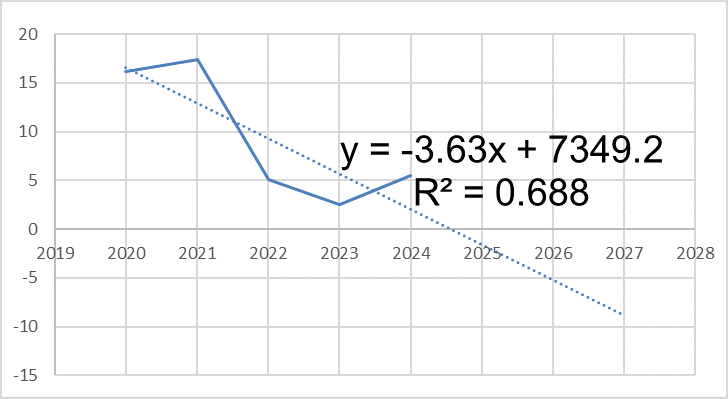

Pic. 7. Federal budget deficit, % of GDP

Deficit reduction: Starting in 2021, there has been a steady decline in the federal budget deficit to GDP. This may indicate more effective budget management, increased revenue, or reduced costs.

Decrease in 2020: The high deficit in 2020 could have been caused by measures to support the economy in the context of the COVID-19 pandemic, which required significant budget expenditures.

Steady decline: A reduction in the deficit in subsequent years indicates economic recovery and improved financial performance.

The federal budget deficit as a percentage of GDP shows a steady downward trend, which may indicate an increase in financial stability and an improvement in the economic situation. The forecast for 2025 and 2026 suggests a further reduction in the deficit.

Pic.8. Monetization level, % of GDP

Decrease in 2021: A significant decrease in the level of monetization in 2021 may be due to the economic consequences of the COVID-19 pandemic, when the demand for money could decrease due to a decrease in economic activity.

Recovery in 2022-2023: An increase in the level of monetization in 2022 and 2023 indicates an economic recovery and an increase in the money supply in circulation, which may be due to measures to stimulate the economy and increase lending.

Decrease in 2024: A slight decrease in the level of monetization in 2024 may indicate a stabilization of the economy and a possible reduction in the money supply in circulation compared to previous years.

The level of monetization of the economy as a percentage of GDP shows fluctuations, with a noticeable decrease in 2021 and a subsequent recovery in 2022 and 2023. The forecast for 2025 and 2026 suggests a slight increase in the level of monetization, which may indicate a continuation of economic recovery and an increase in the money supply in circulation.

Pic. 9. Inflation rate, %

Rising inflation in 2021 and 2022: A significant increase in the inflation rate in 2021 and 2022 may be caused by the effects of the COVID-19 pandemic, disruptions in supply chains, as well as rising commodity and energy prices.

Decrease in 2023: A decrease in the inflation rate in 2023 may indicate stabilization of the economic situation, improvement of supply chains and measures taken to control inflation.

Increase in 2024: The increase in the inflation rate in 2024 may be related to new economic challenges, such as rising energy prices or other factors affecting the cost of living.

The inflation rate shows significant fluctuations, with sharp increases in 2021 and 2022, followed by a decrease in 2023 and a new increase in 2024. The forecast for 2025 and 2026 assumes a further decrease in the inflation rate.

Based on the material which we have studied, we have identified several recommendations that should be adopted to reduce economic security risks, namely:

-Identification of all potential threats that may hinder the development of the country’s economy.

-Quantitative and qualitative assessment of the probability of occurrence of each risk and its potential consequences.

-Creation of a management system that will help minimize risks.

In the course of my research, it can be concluded that the economy shows an ambiguous picture. The positive trends include GDP growth, an increase in life expectancy, as well as improvements in the employment situation. Among the alarming trends are an increase in the share of food imports and fluctuations in grain yields. These indicators, along with rising inflation, are issues that require careful monitoring and policy measures to maintain sustainable growth.

References

1. Kiryanova, A. L. Analysis of Russia's economic security / A. L. Kiryanova. — Text : direct // Young scientist. — 2024. — № 3 (502). — Pp. 222-224. — URL: https://moluch.ru/archive/502/110280 / (accessed: 03/26/2025).2. Abakumov A.S. The National Welfare Fund of the Russian Federation as a guarantee of financial stability // Generation of the future: the view of young scientists – 2021-2021.

3. Danilin E.A., Shabanova A.A. Modern challenges and threats to the economic security of the Russian Federation // Actual problems of management, economics and economic security.

4. Fritzler A.V., Tarkhanova E.A. The impact of external government debt on Russia's economic security // National Security of Russia: current aspects.